Introduction

Did you know that besides being able to mine XLA, you can also be rewarded for providing liquidity on our exchanges? Moreover, by doing so, you contribute to making our order books much healthier and more attractive.

Actively contributing liquidity to our exchanges allows you to play a crucial role in strengthening and sustaining a stable and highly efficient trading environment for Scala. This active involvement enhances market depth and reduces the risk of sudden price fluctuations, ensuring that XLA’s value remains steady and supports smooth trading experiences.

What is a liquidity pool?

A liquidity pool refers to a collectively sourced pool of cryptocurrencies or tokens locked within an exchange, serving the purpose of facilitating trades between different assets. In contrast to traditional markets with distinct buyers and sellers, liquidity pools utilize automated market maker algorithms (AMM), enabling the automatic trading of digital assets through the utilization of these pools. The primary objective of liquidity pools is to address the issue of illiquid markets by encouraging users to contribute cryptocurrency liquidity in exchange for a portion of the trading fees. Unlike traditional trading, utilizing liquidity pools eliminates the need for matching buyers and sellers, allowing users to seamlessly exchange their tokens and assets using the liquidity provided by other users.

What exchanges support liquidity pools?

Liquidity Pools for Scala are currently supported on these exchanges:

- Xeggex: https://xeggex.com/markets

- NonKYC: https://nonkyc.io/markets

Earn profits for providing liquidity

By participating as a liquidity provider, users have the potential to receive a portion of the trading fees generated within the pool, creating a steady stream of income. Furthermore, users can seize the opportunity to accrue daily profits, which are automatically credited to their AMM accounts.

Risks

Impermanent Loss

Assets held in the AMM Account will be incorporated into the liquidity pool for automated market making. Potential impermanent losses may arise due to fluctuations in asset prices, leading to changes in the ratio of the two assets with the price movements. As the price ratio eventually reverts, impermanent losses gradually diminish, and users can ultimately realize profits from participating in liquidity provision.

Trusting a third-party

Storing funds on an exchange always involves risk, as it entails trusting a third-party platform with your assets. We advise against keeping substantial amounts on any exchange and instead suggest securely storing them in one of Scala’s official wallets.

How to add liquidity

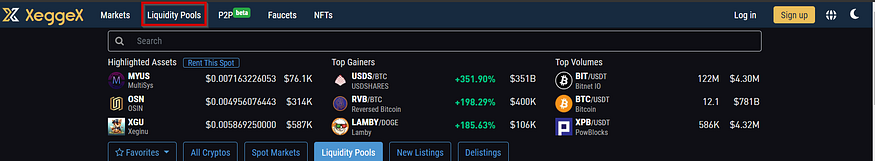

Note: The steps to add liquidity are the same for Xeggex and NonKYC, as they share the same user interface. For this guide, we will use Xeggex.

Step 1

Visit Xeggex or NonKYC official website and log in to your account. Click on ‘Liquidity Pools’ in the drop-down menu of the main menu.

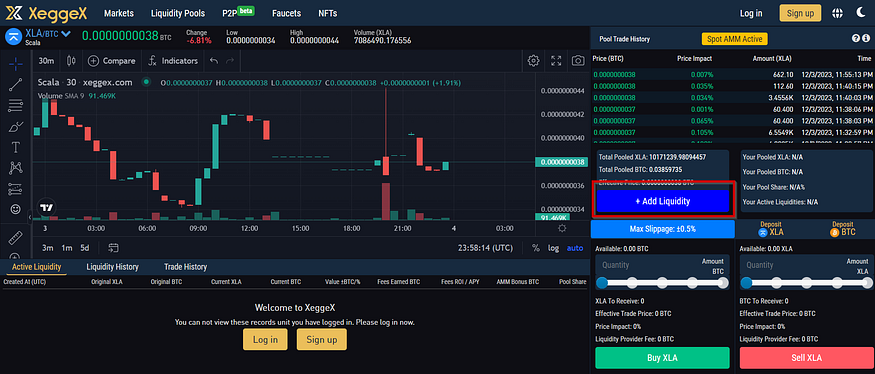

Step 2

Select the trading pair for which you want to add liquidity, for example, XLA/BTC, then click on “Add Liquidity”.

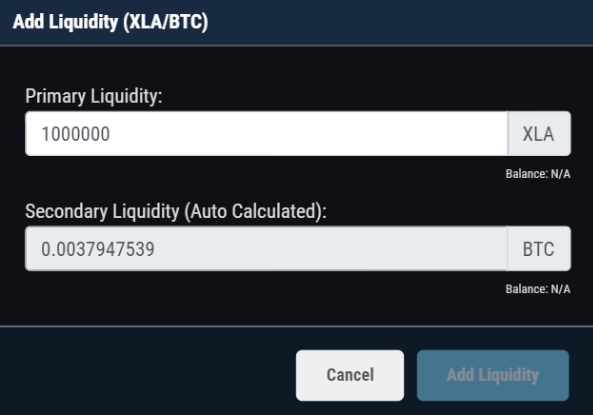

Step 3

Enter the amount of XLA you want to add as liquidity. The amount of the other cryptocurrency (BTC in this case) will be calculated automatically.

Make sure you have enough XLA and BTC in your account, otherwise, the “Add Liquidity” button will be disabled. If not, you need to deposit the required funds on the exchange and then try again.

Congratulations! You’ve successfully provided liquidity to the XLA/BTC pair and can now begin earning rewards. We look forward to having numerous Scalanauts contribute to creating a more robust and liquid order book.